Many Investors have a habit that they do not spend that time and energy in the investigation before investing.

Often men do not get time from their jobs and women from their household works that's why people don't get that much seriousness about investment.

And the result is that people either have half-incomplete knowledge about stocks or there are many misunderstandings but investment business is not completely risk-free, so there are we explain, what you don't have to do as an investor.

|

| Earn the best possible profit with the least risk |

1) Don't get caught up with the promotional companies. Promotional companies are those which are newly launched and want to promote business, it sets up new products or is trying to enter a completely new market. so investing in them would be risky.

2) Don't ignore a good stock just because it is being traded "over the counter " over the counter (OTC)

are those that are bought and sold directly between two parties. These stocks aren't listed in the exchange, people think that these stocks will be very risky but if you find any such stock which looks good prospectus then there is no harm in purchasing it.

3) Don't buy stocks just because you see the annual report seems good. People often read annual reports and get influenced by the words and formats written in it. But seeing the beautiful chart of a company does not mean that it will prove to be a good company accounting to the investment.

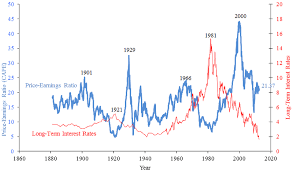

4) Do not think that if a stock is selling at a higher price than earnings, it is an indication that the earning's future growth is already price discounted.in a simple way, a good company will have good chances of selling of better price earning ratio (the ratio between the share on price and the earning).

Of course, the current may seem a bit high, but if the company continues to grow, then their prices will also increase along with it.

5) Don't make the slightest price difference an issue. Let's take an interesting example to understand.

Twenty years ago, a gentleman went to the new york stock exchange to buy 100 shares. at that time the stock was closed at a price of 35.5. Those stocks were constantly closing at the same price and that gentleman didn't want to buy that much. Today some stock has become 500. so in order to save a few dollars, the man missed out on making a profit of $46,500.

so don't miss your golden chance to save some money.

In the next blog, you'll find "5 do" that an investor should do.

That's all for now.

Tags:

Investment-Ideas